PCI DSS Compliance

Align with PCI DSS Compliance standards through expert advisory, official QSA assessments, and ongoing compliance support.

Service Overview

The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized framework designed to protect payment cardholder data and reduce the risk of fraud. It applies to any organization that stores, processes, or transmits cardholder information, including merchants of all sizes, service providers, and financial institutions.

The most current version, PCI DSS v4.0.1 (released in March 2022), defines 12 core requirements supported by detailed testing procedures and implementation guidance. While the previous version (v3.2.1) remained valid through March 2024, all entities must now transition to the updated framework to maintain compliance.

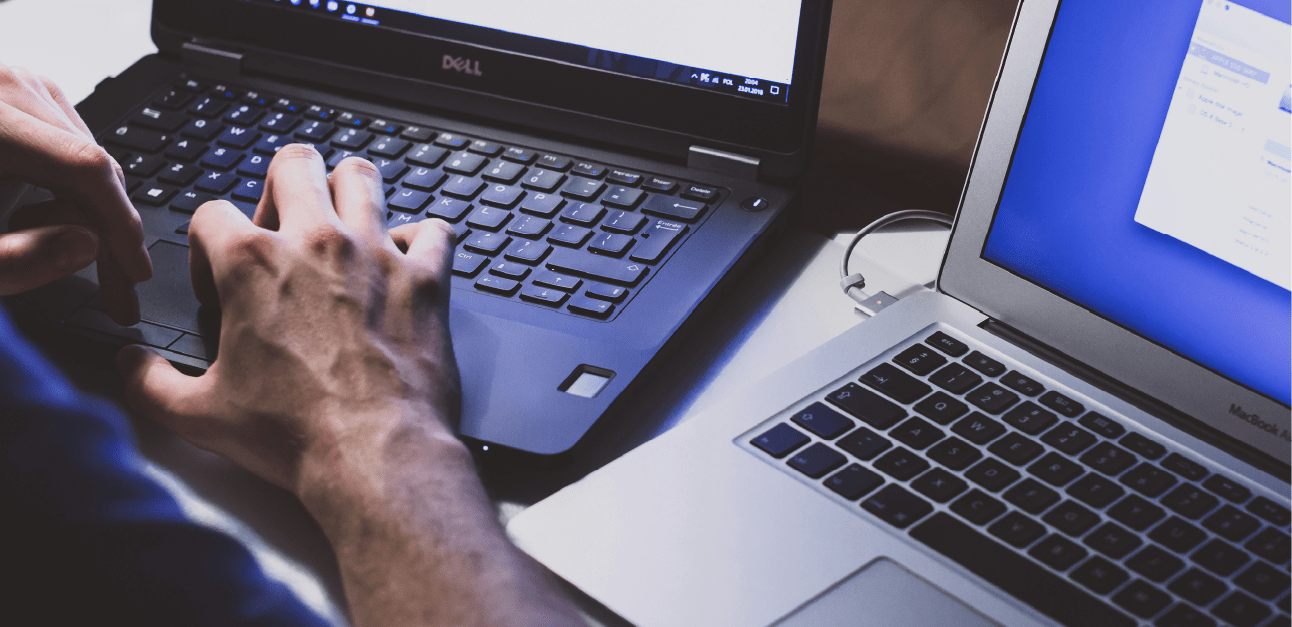

Achieving PCI DSS compliance Services requires organizations to implement and maintain strong security controls across areas such as network protection, access management, encryption, and ongoing monitoring. Compliance is not optional, it is a contractual requirement from the major payment card brands and acquiring banks.

Schedule with a QSA

Achieving and maintaining PCI DSS compliance Services requires more than technical controls, it demands expert oversight and validation. As an accredited Qualified Security Assessor (QSA) and Approved Scanning Vendor (ASV), RSI Security provides the trusted expertise you need to navigate the full compliance process with confidence.

Whether you’re seeking an initial certification or preparing for your next annual assessment, scheduling with a QSA ensures your organization is not only compliant but also protected against evolving threats.

Schedule A Consultation

How to Achieve PCI DSS Compliance

Achieving PCI DSS certification requires more than checking boxes, it’s about implementing strong, repeatable processes that safeguard cardholder data and ensure long-term compliance. The PCI Security Standards Council (PCI SSC) recommends a three-step process:

Assess

Inventory your cardholder data, processes, and systems. Identify where sensitive data is stored, processed, or transmitted, and evaluate them for security vulnerabilities. Document findings clearly for remediation.

Remediate

Address vulnerabilities by applying the PCI DSS requirements. This may include eliminating unnecessary data storage, strengthening encryption, and improving access controls. The goal is to reduce risk while building a more secure environment.

Report

Compile evidence of compliance, including remediation steps and

ongoing safeguards. Submit the required reports to acquiring banks

and card brands to validatecertification.

“Protecting payment card data through PCI DSS compliance demonstrates a company’s commitment to security and can be a competitive differentiator in the marketplace.

— PCI SSC Insights Blog

Why Choose PCI DSS Compliance Services ?

PCI DSS compliance shows your commitment to keeping customer payment data safe and reducing fraud. The standard’s 12 core requirements provide a trusted framework for protecting cardholder information across systems and processes.

Compliance isn’t just about meeting requirements, it’s about safeguarding trust. Non-compliance can lead to fines, higher fees, loss of card processing privileges, and serious reputational damage if a breach occurs.

At RSI Security, we help you navigate these challenges efficiently so your business stays protected, trusted, and ready for growth.

Benefits of PCI DSS Compliance Services

Your Compliance Partner

RSI Security is a leading provider of cyber defense and compliance services. Our team’s extensive experience, particularly in emerging AI technology, equips us to offer unique insights and efficient solutions to the challenges many organizations face when implementing PCI DSS.

We will prepare you for all stages of your implementation and assessment, including connecting you with an auditor and acting as liaison during the certification process.

We have successfully helped organizations achieve compliance with various standards and regulations, including ISO 27001 and ISO 42001, as well as HIPAA, PCI DSS, CMMC, and others.

We know that disciplined security practices drive long-term, sustainable growth, and we are committed to helping you achieve that.